Why are fundraisers down on DAFs? - Part 1

I hear fundraisers complain about gifts received through Donor Advised Funds, known as DAFs.

"I never know who is actually giving."

"I can't steward these people properly!" (nor cultivate the donor for a second gift.)

"We have major donors who have stopped giving - how do I know if they are now giving through a DAF?"

Giving through Donor Advised Funds has been going on for a long time. In my very first fundraising position, I received gifts from donors through the Seattle Foundation and Jewish Federation, to name just two that had donor advised funds within the organizations. But things have really changed.

Donor advised funds today are wildly popular with investor-donors and represent a great deal of wealth poised to be applied to do good.

They are also fairly unregulated, as compared to previous foundation-based organizations that had donor advised funds within them. You might already know that the largest DAF sponsor is Fidelity Charitable, with over $35 billion in assets as of 2020. (Fun fact: only the Gates Foundation is larger, with its nearly $52 billion in assets.) The under-regulated nature of these funds can be frustrating. Read more here: The Rise of the Monster DAFs from The Institute for Policy Studies.

But here is the thing to remember: this wealth has already been given by a donor with the intent for a charitable impact. Funds in a DAF represent giving that has intent for community impact but where the desired impact has not yet been realized.

But this isn't how donors see it. And it isn't how they are being spoken to about DAFs and their potential.

I was searching for an original source on giving and volunteering and landed on this Fidelity page. As you'll see, they use all the language I learned in my certificate in Donor Psychology: language that speaks to autonomy, competence and connectedness. Essentially, what creates donor well-being.

And the benefits of giving Fidelity talks about? It's all about the investor-donor. Read on to see their language - the underscores are mine.

Almost all the underscored sections are about the donor-investor making their own choice or charting their own path, making wise choices and decisions and/ or connectedness to organizations "you want to support."

And the benefits of giving? It's all about the investor-donor. Read on to see part of their page - the underscores are mine:

Fundraisers - learn to love Donor Advised Funds and take action accordingly.

I suggest fundraisers and leaders learn to love the DAFs - it is charitable money already designated to give away - so conversations with donors about giving from assets like a Donor Advised Fund may yield better giving impacts.

I'll offer proactive steps in my next post.

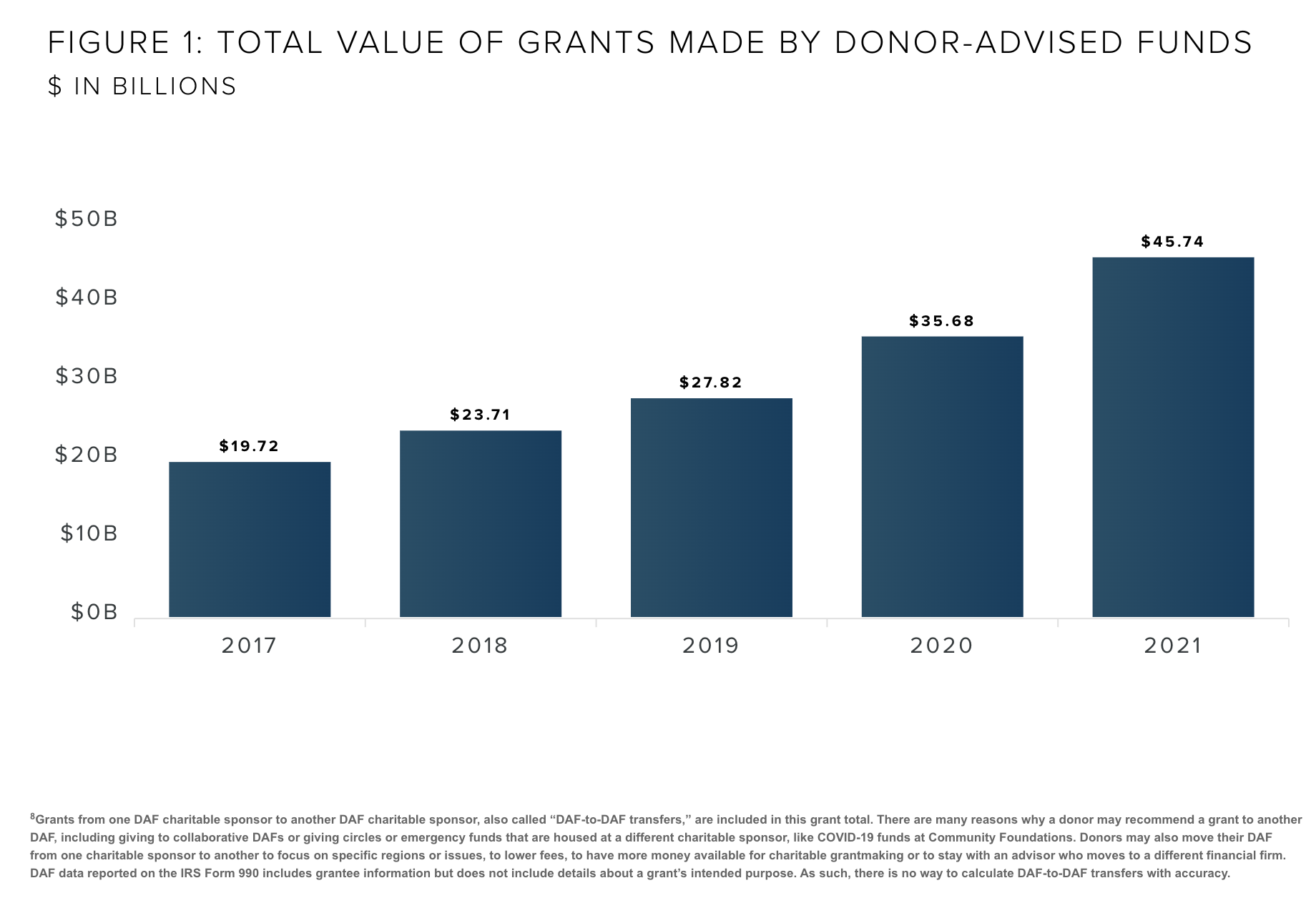

P.S. you might like to read more from the National Philanthropic Trust's Donor-Advised Fund Report. Dig into details like: grants from DAFs to charitable organizations in 2021 reached a new high at $45.74 billion, and 28.2% increase from 2020.